Hey there, First post after many hours of trial and error here. Also, brand new to EDT, but yes a forever user here excited to learn.

What im trying to achieve is quite simple.

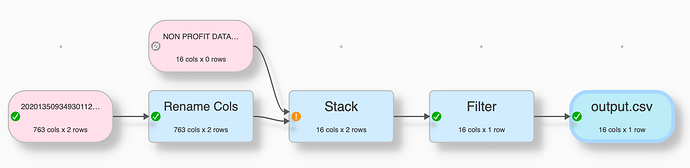

I’ve created a CSV (Non Profit Database.csv) with the columns named appropriately for ONLY the data I’d like to keep from each XML file.

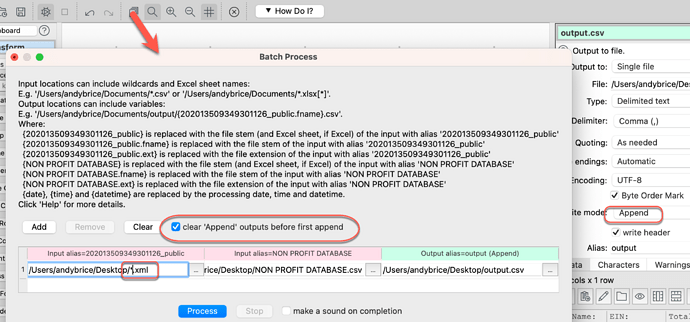

Id like to be able to run a batch so that it will simply add a new row to the single (Non Profit Database.csv) for each company based on the EIN number from each XML file.

Iv’e attached both the Non Profit Database.csv AND an example XML file which is the exact same structure (with different data points of course) as all the other XML files id like to batch together.

Im very thankful for your help with this and have failed with my attempts to use JOIN to point each column individually and get the batch working.

Here is the Non Profit Database CSV columns:

Name:,EIN:,Total Revenue:,Total Functional Expenses:,Net income:,Executive compensation:,Other salaries and wages:,Total Assets:,Total Liabilities:,Net Assets:,Employee Count:,Address:,Website:,Email:,Phone:,CEO:

Here is the XML data example:

<Return xmlns="http://www.irs.gov/efile" xmlns:xsi="http://www.w3.org/2001/XMLSchema-instance" returnVersion="2019v5.0">

<style lang="en" type="text/css" id="night-mode-pro-style">html {background-color: #FFFFFF !important;} body {background-color: #FFFFFF;}</style>

<link type="text/css" rel="stylesheet" id="night-mode-pro-link"/>

<ReturnHeader binaryAttachmentCnt="0">

<ReturnTs>2020-12-15T14:25:21-06:00</ReturnTs>

<TaxPeriodEndDt>2020-06-30</TaxPeriodEndDt>

<PreparerFirmGrp>

<PreparerFirmEIN>731331618</PreparerFirmEIN>

<PreparerFirmName>

<BusinessNameLine1Txt>LUTON & CO PLLC</BusinessNameLine1Txt>

</PreparerFirmName>

<PreparerUSAddress>

<AddressLine1Txt>201 NW 63RD ST STE 100</AddressLine1Txt>

<CityNm>OKLAHOMA CITY</CityNm>

<StateAbbreviationCd>OK</StateAbbreviationCd>

<ZIPCd>73116</ZIPCd>

</PreparerUSAddress>

</PreparerFirmGrp>

<ReturnTypeCd>990</ReturnTypeCd>

<TaxPeriodBeginDt>2019-07-01</TaxPeriodBeginDt>

<Filer>

<EIN>582670613</EIN>

<BusinessName>

<BusinessNameLine1Txt>HEARTS FOR HEARING FOUNDATION</BusinessNameLine1Txt>

</BusinessName>

<BusinessNameControlTxt>HEAR</BusinessNameControlTxt>

<PhoneNum>4055484300</PhoneNum>

<USAddress>

<AddressLine1Txt>11500 PORTLAND AVE</AddressLine1Txt>

<CityNm>OKLAHOMA CITY</CityNm>

<StateAbbreviationCd>OK</StateAbbreviationCd>

<ZIPCd>73120</ZIPCd>

</USAddress>

</Filer>

<BusinessOfficerGrp>

<PersonNm>JOANNA T SMITH</PersonNm>

<PersonTitleTxt>CHIEF EXEC OFFICER</PersonTitleTxt>

<PhoneNum>4055484300</PhoneNum>

<SignatureDt>2020-10-31</SignatureDt>

<DiscussWithPaidPreparerInd>true</DiscussWithPaidPreparerInd>

</BusinessOfficerGrp>

<PreparerPersonGrp>

<PreparerPersonNm>DAVID R BRADY</PreparerPersonNm>

<PTIN>P01228402</PTIN>

<PhoneNum>4058487313</PhoneNum>

<PreparationDt>2020-12-15</PreparationDt>

</PreparerPersonGrp>

<FilingSecurityInformation>

<IPAddress>

<IPv4AddressTxt>70.182.82.167</IPv4AddressTxt>

</IPAddress>

<IPDt>2020-12-15</IPDt>

<IPTm>14:25:21</IPTm>

<IPTimezoneCd>CS</IPTimezoneCd>

<FilingLicenseTypeCd>P</FilingLicenseTypeCd>

<AtSubmissionCreationDeviceId>B8F39B814E002FE3D8791520AB9538398F819F10</AtSubmissionCreationDeviceId>

<AtSubmissionFilingDeviceId>731A42FD87283B4B84E10806E51163ECABF1C7A2</AtSubmissionFilingDeviceId>

</FilingSecurityInformation>

<TaxYr>2019</TaxYr>

<BuildTS>2021-01-29 14:40:06Z</BuildTS>

</ReturnHeader>

<ReturnData documentCnt="7">

<IRS990 documentId="RetDoc2" referenceDocumentId="RetDoc6">

<PrincipalOfficerNm>JOANNA T SMITH</PrincipalOfficerNm>

<USAddress>

<AddressLine1Txt>11500 PORTLAND AVE</AddressLine1Txt>

<CityNm>OKLAHOMA CITY</CityNm>

<StateAbbreviationCd>OK</StateAbbreviationCd>

<ZIPCd>73120</ZIPCd>

</USAddress>

<GrossReceiptsAmt>10231160</GrossReceiptsAmt>

<GroupReturnForAffiliatesInd>false</GroupReturnForAffiliatesInd>

<Organization501c3Ind>X</Organization501c3Ind>

<WebsiteAddressTxt>WWW.HEARTSFORHEARING.ORG</WebsiteAddressTxt>

<TypeOfOrganizationCorpInd>X</TypeOfOrganizationCorpInd>

<FormationYr>2003</FormationYr>

<LegalDomicileStateCd>OK</LegalDomicileStateCd>

<ActivityOrMissionDesc>HEARTS FOR HEARING CREATES LIFE-CHANGING OPPORTUNITIES FOR CHILDREN AND ADULTS WITH HEARING LOSS TO LISTEN FOR A LIFETIME.</ActivityOrMissionDesc>

<VotingMembersGoverningBodyCnt>15</VotingMembersGoverningBodyCnt>

<VotingMembersIndependentCnt>15</VotingMembersIndependentCnt>

<TotalEmployeeCnt>111</TotalEmployeeCnt>

<TotalVolunteersCnt>12</TotalVolunteersCnt>

<TotalGrossUBIAmt>0</TotalGrossUBIAmt>

<PYContributionsGrantsAmt>4960835</PYContributionsGrantsAmt>

<CYContributionsGrantsAmt>5142288</CYContributionsGrantsAmt>

<PYProgramServiceRevenueAmt>5191405</PYProgramServiceRevenueAmt>

<CYProgramServiceRevenueAmt>5019590</CYProgramServiceRevenueAmt>

<PYInvestmentIncomeAmt>22855</PYInvestmentIncomeAmt>

<CYInvestmentIncomeAmt>26703</CYInvestmentIncomeAmt>

<PYOtherRevenueAmt>54133</PYOtherRevenueAmt>

<CYOtherRevenueAmt>42579</CYOtherRevenueAmt>

<PYTotalRevenueAmt>10229228</PYTotalRevenueAmt>

<CYTotalRevenueAmt>10231160</CYTotalRevenueAmt>

<CYGrantsAndSimilarPaidAmt>0</CYGrantsAndSimilarPaidAmt>

<CYBenefitsPaidToMembersAmt>0</CYBenefitsPaidToMembersAmt>

<PYSalariesCompEmpBnftPaidAmt>5342824</PYSalariesCompEmpBnftPaidAmt>

<CYSalariesCompEmpBnftPaidAmt>6593638</CYSalariesCompEmpBnftPaidAmt>

<CYTotalProfFndrsngExpnsAmt>0</CYTotalProfFndrsngExpnsAmt>

<CYTotalFundraisingExpenseAmt>396182</CYTotalFundraisingExpenseAmt>

<PYOtherExpensesAmt>2895803</PYOtherExpensesAmt>

<CYOtherExpensesAmt>3059602</CYOtherExpensesAmt>

<PYTotalExpensesAmt>8238627</PYTotalExpensesAmt>

<CYTotalExpensesAmt>9653240</CYTotalExpensesAmt>

<PYRevenuesLessExpensesAmt>1990601</PYRevenuesLessExpensesAmt>

<CYRevenuesLessExpensesAmt>577920</CYRevenuesLessExpensesAmt>

<TotalAssetsBOYAmt>16034989</TotalAssetsBOYAmt>

<TotalAssetsEOYAmt>17557139</TotalAssetsEOYAmt>

<TotalLiabilitiesBOYAmt>1025202</TotalLiabilitiesBOYAmt>

<TotalLiabilitiesEOYAmt>1969373</TotalLiabilitiesEOYAmt>

<NetAssetsOrFundBalancesBOYAmt>15009787</NetAssetsOrFundBalancesBOYAmt>

<NetAssetsOrFundBalancesEOYAmt>15587766</NetAssetsOrFundBalancesEOYAmt>

<InfoInScheduleOPartIIIInd>X</InfoInScheduleOPartIIIInd>

<MissionDesc>TO MAXIMIZE THE ABILITIES OF INDIVIDUALS WHO ARE DEAF OR HARD OF HEARING TO BE ABLE TO LISTEN AND TALK BY PROVIDING DIRECT AUDIOLOGICAL AND AUDITORY VERBAL THERAPY SERVICES.</MissionDesc>

<SignificantNewProgramSrvcInd>false</SignificantNewProgramSrvcInd>

<SignificantChangeInd>false</SignificantChangeInd>

<ExpenseAmt>8701257</ExpenseAmt>

<RevenueAmt>5019590</RevenueAmt>

<Desc>HEARTS FOR HEARING CREATES LIFE-CHANGING OPPORTUNITIES FOR CHILDREN AND ADULTS WITH HEARING LOSS TO LISTEN FOR A LIFETIME, PROVIDING COMPREHENSIVE HEARING HEALTHCARE TO CHILDREN AND ADULTS. IN ADDITION TO THE DIAGNOSIS OF HEARING LOSS IN BABIES SHORTLY AFTER BIRTH, WE PROVIDE THE FIRST SET OF HEARING AIDS TO EVERY CHILD IN OKLAHOMA UNDER THE AGE OF 6 AT NO COST TO THE FAMILY. IN ADDITION TO THE FITTING OF HEARING AIDS AND REMOTE MICROPHONE TECHNOLOGY, WE ARE A COMPREHENSIVE COCHLEAR IMPLANT CENTER FOR CHILDREN AND ADULTS AND OFFER COCHLEAR IMPLANT MAPPING,LISTENING AND SPOKEN LANGUAGE SERVICES (LSL), "BRIDGES" GROUP THERAPY AND COMMUNITY HEARING SCREENING PROGRAMS. HEARTS FOR HEARING ALSO CONTRIBUTES TO THE KNOWLEDGE BASE WORLDWIDE IN THE FIELD OF HEARING AID AND COCHLEAR IMPLANT TECHNOLOGY THROUGH A ROBUST RESEARCH INITIATIVE.</Desc>

<TotalProgramServiceExpensesAmt>8701257</TotalProgramServiceExpensesAmt>

<DescribedInSection501c3Ind referenceDocumentId="RetDoc7">true</DescribedInSection501c3Ind>

<ScheduleBRequiredInd referenceDocumentId="RetDoc1">true</ScheduleBRequiredInd>

<PoliticalCampaignActyInd>false</PoliticalCampaignActyInd>

<LobbyingActivitiesInd>false</LobbyingActivitiesInd>

<SubjectToProxyTaxInd>false</SubjectToProxyTaxInd>

<DonorAdvisedFundInd referenceDocumentId="RetDoc3">false</DonorAdvisedFundInd>

<ConservationEasementsInd referenceDocumentId="RetDoc3">false</ConservationEasementsInd>

<CollectionsOfArtInd referenceDocumentId="RetDoc3">false</CollectionsOfArtInd>

<CreditCounselingInd referenceDocumentId="RetDoc3">false</CreditCounselingInd>

<DonorRstrOrQuasiEndowmentsInd referenceDocumentId="RetDoc3">true</DonorRstrOrQuasiEndowmentsInd>

<ReportLandBuildingEquipmentInd referenceDocumentId="RetDoc3">true</ReportLandBuildingEquipmentInd>

<ReportInvestmentsOtherSecInd referenceDocumentId="RetDoc3">false</ReportInvestmentsOtherSecInd>

<ReportProgramRelatedInvstInd referenceDocumentId="RetDoc3">false</ReportProgramRelatedInvstInd>

<ReportOtherAssetsInd referenceDocumentId="RetDoc3">true</ReportOtherAssetsInd>

<ReportOtherLiabilitiesInd referenceDocumentId="RetDoc3">false</ReportOtherLiabilitiesInd>

<IncludeFIN48FootnoteInd referenceDocumentId="RetDoc3">false</IncludeFIN48FootnoteInd>

<IndependentAuditFinclStmtInd referenceDocumentId="RetDoc3">true</IndependentAuditFinclStmtInd>

<ConsolidatedAuditFinclStmtInd referenceDocumentId="RetDoc3">false</ConsolidatedAuditFinclStmtInd>

<SchoolOperatingInd>false</SchoolOperatingInd>

<ForeignOfficeInd>false</ForeignOfficeInd>

<ForeignActivitiesInd>false</ForeignActivitiesInd>

<MoreThan5000KToOrgInd>false</MoreThan5000KToOrgInd>

<MoreThan5000KToIndividualsInd>false</MoreThan5000KToIndividualsInd>

<ProfessionalFundraisingInd>false</ProfessionalFundraisingInd>

<FundraisingActivitiesInd>false</FundraisingActivitiesInd>

<GamingActivitiesInd>false</GamingActivitiesInd>

<OperateHospitalInd>false</OperateHospitalInd>

<GrantsToOrganizationsInd>false</GrantsToOrganizationsInd>

<GrantsToIndividualsInd>false</GrantsToIndividualsInd>

<ScheduleJRequiredInd referenceDocumentId="RetDoc4">true</ScheduleJRequiredInd>

<TaxExemptBondsInd>false</TaxExemptBondsInd>

<EngagedInExcessBenefitTransInd>false</EngagedInExcessBenefitTransInd>

<PYExcessBenefitTransInd>false</PYExcessBenefitTransInd>

<LoanOutstandingInd>false</LoanOutstandingInd>

<GrantToRelatedPersonInd>false</GrantToRelatedPersonInd>

<BusinessRlnWithOrgMemInd>false</BusinessRlnWithOrgMemInd>

<BusinessRlnWithFamMemInd>false</BusinessRlnWithFamMemInd>

<BusinessRlnWith35CtrlEntInd>false</BusinessRlnWith35CtrlEntInd>

<DeductibleNonCashContriInd referenceDocumentId="RetDoc5">true</DeductibleNonCashContriInd>

<DeductibleArtContributionInd referenceDocumentId="RetDoc5">false</DeductibleArtContributionInd>

<TerminateOperationsInd>false</TerminateOperationsInd>

<PartialLiquidationInd>false</PartialLiquidationInd>

<DisregardedEntityInd>false</DisregardedEntityInd>

<RelatedEntityInd>false</RelatedEntityInd>

<RelatedOrganizationCtrlEntInd>false</RelatedOrganizationCtrlEntInd>

<TrnsfrExmptNonChrtblRltdOrgInd>false</TrnsfrExmptNonChrtblRltdOrgInd>

<ActivitiesConductedPrtshpInd>false</ActivitiesConductedPrtshpInd>

<ScheduleORequiredInd>true</ScheduleORequiredInd>

<IRPDocumentCnt>15</IRPDocumentCnt>

<IRPDocumentW2GCnt>0</IRPDocumentW2GCnt>

<EmployeeCnt>111</EmployeeCnt>

<EmploymentTaxReturnsFiledInd>true</EmploymentTaxReturnsFiledInd>

<UnrelatedBusIncmOverLimitInd>false</UnrelatedBusIncmOverLimitInd>

<ForeignFinancialAccountInd>false</ForeignFinancialAccountInd>

<ProhibitedTaxShelterTransInd>false</ProhibitedTaxShelterTransInd>

<TaxablePartyNotificationInd>false</TaxablePartyNotificationInd>

<NondeductibleContributionsInd>false</NondeductibleContributionsInd>

<QuidProQuoContributionsInd>false</QuidProQuoContributionsInd>

<Form8282PropertyDisposedOfInd>false</Form8282PropertyDisposedOfInd>

<RcvFndsToPayPrsnlBnftCntrctInd>false</RcvFndsToPayPrsnlBnftCntrctInd>

<PayPremiumsPrsnlBnftCntrctInd>false</PayPremiumsPrsnlBnftCntrctInd>

<IndoorTanningServicesInd>false</IndoorTanningServicesInd>

<SubjToTaxRmnrtnExPrchtPymtInd>false</SubjToTaxRmnrtnExPrchtPymtInd>

<SubjectToExcsTaxNetInvstIncInd>false</SubjectToExcsTaxNetInvstIncInd>

<InfoInScheduleOPartVIInd>X</InfoInScheduleOPartVIInd>

<GoverningBodyVotingMembersCnt>15</GoverningBodyVotingMembersCnt>

<IndependentVotingMemberCnt>15</IndependentVotingMemberCnt>

<FamilyOrBusinessRlnInd>false</FamilyOrBusinessRlnInd>

<DelegationOfMgmtDutiesInd>false</DelegationOfMgmtDutiesInd>

<ChangeToOrgDocumentsInd>false</ChangeToOrgDocumentsInd>

<MaterialDiversionOrMisuseInd>false</MaterialDiversionOrMisuseInd>

<MembersOrStockholdersInd>false</MembersOrStockholdersInd>

<ElectionOfBoardMembersInd>false</ElectionOfBoardMembersInd>

<DecisionsSubjectToApprovaInd>false</DecisionsSubjectToApprovaInd>

<MinutesOfGoverningBodyInd>true</MinutesOfGoverningBodyInd>

<MinutesOfCommitteesInd>true</MinutesOfCommitteesInd>

<OfficerMailingAddressInd>false</OfficerMailingAddressInd>

<LocalChaptersInd>false</LocalChaptersInd>

<Form990ProvidedToGvrnBodyInd>true</Form990ProvidedToGvrnBodyInd>

<ConflictOfInterestPolicyInd>true</ConflictOfInterestPolicyInd>

<AnnualDisclosureCoveredPrsnInd>true</AnnualDisclosureCoveredPrsnInd>

<RegularMonitoringEnfrcInd>true</RegularMonitoringEnfrcInd>

<WhistleblowerPolicyInd>true</WhistleblowerPolicyInd>

<DocumentRetentionPolicyInd>true</DocumentRetentionPolicyInd>

<CompensationProcessCEOInd>true</CompensationProcessCEOInd>

<CompensationProcessOtherInd>true</CompensationProcessOtherInd>

<InvestmentInJointVentureInd>false</InvestmentInJointVentureInd>

<StatesWhereCopyOfReturnIsFldCd>OK</StatesWhereCopyOfReturnIsFldCd>

<UponRequestInd>X</UponRequestInd>

<BooksInCareOfDetail>

<PersonNm>JOANNA T SMITH</PersonNm>

<PhoneNum>4055484300</PhoneNum>

<USAddress>

<AddressLine1Txt>11500 PORTLAND AVE</AddressLine1Txt>

<CityNm>OKLAHOMA CITY</CityNm>

<StateAbbreviationCd>OK</StateAbbreviationCd>

<ZIPCd>73120</ZIPCd>

</USAddress>

</BooksInCareOfDetail>

<Form990PartVIISectionAGrp>

<PersonNm>JACE WOLFE</PersonNm>

<TitleTxt>EMPLOYEE</TitleTxt>

<AverageHoursPerWeekRt>40.00</AverageHoursPerWeekRt>

<HighestCompensatedEmployeeInd>X</HighestCompensatedEmployeeInd>

<ReportableCompFromOrgAmt>289665</ReportableCompFromOrgAmt>

<ReportableCompFromRltdOrgAmt>0</ReportableCompFromRltdOrgAmt>

<OtherCompensationAmt>15899</OtherCompensationAmt>

</Form990PartVIISectionAGrp>

<Form990PartVIISectionAGrp>

<PersonNm>RACHEL A MAGANN FAIVRE</PersonNm>

<TitleTxt>EMPLOYEE</TitleTxt>

<AverageHoursPerWeekRt>40.00</AverageHoursPerWeekRt>

<HighestCompensatedEmployeeInd>X</HighestCompensatedEmployeeInd>

<ReportableCompFromOrgAmt>162252</ReportableCompFromOrgAmt>

<ReportableCompFromRltdOrgAmt>0</ReportableCompFromRltdOrgAmt>

<OtherCompensationAmt>12113</OtherCompensationAmt>

</Form990PartVIISectionAGrp>

<Form990PartVIISectionAGrp>

<PersonNm>JOANNA T SMITH</PersonNm>

<TitleTxt>CHIEF EXEC O</TitleTxt>

<AverageHoursPerWeekRt>40.00</AverageHoursPerWeekRt>

<OfficerInd>X</OfficerInd>

<ReportableCompFromOrgAmt>136917</ReportableCompFromOrgAmt>

<ReportableCompFromRltdOrgAmt>0</ReportableCompFromRltdOrgAmt>

<OtherCompensationAmt>12097</OtherCompensationAmt>

</Form990PartVIISectionAGrp>

<Form990PartVIISectionAGrp>

<PersonNm>ROBERT G WOOD</PersonNm>

<TitleTxt>CHIEF OPERAT</TitleTxt>

<AverageHoursPerWeekRt>40.00</AverageHoursPerWeekRt>

<OfficerInd>X</OfficerInd>

<ReportableCompFromOrgAmt>135846</ReportableCompFromOrgAmt>

<ReportableCompFromRltdOrgAmt>0</ReportableCompFromRltdOrgAmt>

<OtherCompensationAmt>11279</OtherCompensationAmt>

</Form990PartVIISectionAGrp>

<Form990PartVIISectionAGrp>

<PersonNm>KRISTIN HOPPER</PersonNm>

<TitleTxt>EMPLOYEE</TitleTxt>

<AverageHoursPerWeekRt>40.00</AverageHoursPerWeekRt>

<HighestCompensatedEmployeeInd>X</HighestCompensatedEmployeeInd>

<ReportableCompFromOrgAmt>111932</ReportableCompFromOrgAmt>

<ReportableCompFromRltdOrgAmt>0</ReportableCompFromRltdOrgAmt>

<OtherCompensationAmt>11096</OtherCompensationAmt>

</Form990PartVIISectionAGrp>

<Form990PartVIISectionAGrp>

<PersonNm>SHANNON R WINTERS</PersonNm>

<TitleTxt>EMPLOYEE</TitleTxt>

<AverageHoursPerWeekRt>40.00</AverageHoursPerWeekRt>

<HighestCompensatedEmployeeInd>X</HighestCompensatedEmployeeInd>

<ReportableCompFromOrgAmt>111864</ReportableCompFromOrgAmt>

<ReportableCompFromRltdOrgAmt>0</ReportableCompFromRltdOrgAmt>

<OtherCompensationAmt>11007</OtherCompensationAmt>

</Form990PartVIISectionAGrp>

<Form990PartVIISectionAGrp>

<PersonNm>ESTHER H KIM</PersonNm>

<TitleTxt>EMPLOYEE</TitleTxt>

<AverageHoursPerWeekRt>40.00</AverageHoursPerWeekRt>

<HighestCompensatedEmployeeInd>X</HighestCompensatedEmployeeInd>

<ReportableCompFromOrgAmt>108472</ReportableCompFromOrgAmt>

<ReportableCompFromRltdOrgAmt>0</ReportableCompFromRltdOrgAmt>

<OtherCompensationAmt>10885</OtherCompensationAmt>

</Form990PartVIISectionAGrp>

<Form990PartVIISectionAGrp>

<PersonNm>KRISTI MURPHY</PersonNm>

<TitleTxt>CFO</TitleTxt>

<AverageHoursPerWeekRt>40.00</AverageHoursPerWeekRt>

<OfficerInd>X</OfficerInd>

<ReportableCompFromOrgAmt>75440</ReportableCompFromOrgAmt>

<ReportableCompFromRltdOrgAmt>0</ReportableCompFromRltdOrgAmt>

<OtherCompensationAmt>7367</OtherCompensationAmt>

</Form990PartVIISectionAGrp>

<Form990PartVIISectionAGrp>

<PersonNm>DAVID BIRDWELL</PersonNm>

<TitleTxt>DIRECTOR</TitleTxt>

<AverageHoursPerWeekRt>1.00</AverageHoursPerWeekRt>

<IndividualTrusteeOrDirectorInd>X</IndividualTrusteeOrDirectorInd>

<ReportableCompFromOrgAmt>0</ReportableCompFromOrgAmt>

<ReportableCompFromRltdOrgAmt>0</ReportableCompFromRltdOrgAmt>

<OtherCompensationAmt>0</OtherCompensationAmt>

</Form990PartVIISectionAGrp>

<Form990PartVIISectionAGrp>

<PersonNm>RANDY CORP</PersonNm>

<TitleTxt>DIRECTOR</TitleTxt>

<AverageHoursPerWeekRt>1.00</AverageHoursPerWeekRt>

<IndividualTrusteeOrDirectorInd>X</IndividualTrusteeOrDirectorInd>

<ReportableCompFromOrgAmt>0</ReportableCompFromOrgAmt>

<ReportableCompFromRltdOrgAmt>0</ReportableCompFromRltdOrgAmt>

<OtherCompensationAmt>0</OtherCompensationAmt>

</Form990PartVIISectionAGrp>

<Form990PartVIISectionAGrp>

<PersonNm>CATHY CROSS</PersonNm>

<TitleTxt>DIRECTOR</TitleTxt>

<AverageHoursPerWeekRt>1.00</AverageHoursPerWeekRt>

<IndividualTrusteeOrDirectorInd>X</IndividualTrusteeOrDirectorInd>

<ReportableCompFromOrgAmt>0</ReportableCompFromOrgAmt>

<ReportableCompFromRltdOrgAmt>0</ReportableCompFromRltdOrgAmt>

<OtherCompensationAmt>0</OtherCompensationAmt>

</Form990PartVIISectionAGrp>

<Form990PartVIISectionAGrp>

<PersonNm>ROBERT GARY</PersonNm>

<TitleTxt>DIRECTOR</TitleTxt>

<AverageHoursPerWeekRt>1.00</AverageHoursPerWeekRt>

<IndividualTrusteeOrDirectorInd>X</IndividualTrusteeOrDirectorInd>

<ReportableCompFromOrgAmt>0</ReportableCompFromOrgAmt>

<ReportableCompFromRltdOrgAmt>0</ReportableCompFromRltdOrgAmt>

<OtherCompensationAmt>0</OtherCompensationAmt>

</Form990PartVIISectionAGrp>

<Form990PartVIISectionAGrp>

<PersonNm>NOVA HAMMERSLEY</PersonNm>

<TitleTxt>DIRECTOR</TitleTxt>

<AverageHoursPerWeekRt>1.00</AverageHoursPerWeekRt>

<IndividualTrusteeOrDirectorInd>X</IndividualTrusteeOrDirectorInd>

<ReportableCompFromOrgAmt>0</ReportableCompFromOrgAmt>

<ReportableCompFromRltdOrgAmt>0</ReportableCompFromRltdOrgAmt>

<OtherCompensationAmt>0</OtherCompensationAmt>

</Form990PartVIISectionAGrp>

<Form990PartVIISectionAGrp>

<PersonNm>KATIE HENKE</PersonNm>

<TitleTxt>DIRECTOR</TitleTxt>

<AverageHoursPerWeekRt>1.00</AverageHoursPerWeekRt>

<IndividualTrusteeOrDirectorInd>X</IndividualTrusteeOrDirectorInd>

<ReportableCompFromOrgAmt>0</ReportableCompFromOrgAmt>

<ReportableCompFromRltdOrgAmt>0</ReportableCompFromRltdOrgAmt>

<OtherCompensationAmt>0</OtherCompensationAmt>

</Form990PartVIISectionAGrp>

<Form990PartVIISectionAGrp>

<PersonNm>LIBBY HOWARD</PersonNm>

<TitleTxt>DIRECTOR</TitleTxt>

<AverageHoursPerWeekRt>1.00</AverageHoursPerWeekRt>

<IndividualTrusteeOrDirectorInd>X</IndividualTrusteeOrDirectorInd>

<ReportableCompFromOrgAmt>0</ReportableCompFromOrgAmt>

<ReportableCompFromRltdOrgAmt>0</ReportableCompFromRltdOrgAmt>

<OtherCompensationAmt>0</OtherCompensationAmt>

</Form990PartVIISectionAGrp>

<Form990PartVIISectionAGrp>

<PersonNm>MIKE KEESTER</PersonNm>

<TitleTxt>DIRECTOR</TitleTxt>

<AverageHoursPerWeekRt>1.00</AverageHoursPerWeekRt>

<IndividualTrusteeOrDirectorInd>X</IndividualTrusteeOrDirectorInd>

<ReportableCompFromOrgAmt>0</ReportableCompFromOrgAmt>

<ReportableCompFromRltdOrgAmt>0</ReportableCompFromRltdOrgAmt>

<OtherCompensationAmt>0</OtherCompensationAmt>

</Form990PartVIISectionAGrp>

<Form990PartVIISectionAGrp>

<PersonNm>JIM MORRIS</PersonNm>

<TitleTxt>DIRECTOR</TitleTxt>

<AverageHoursPerWeekRt>1.00</AverageHoursPerWeekRt>

<IndividualTrusteeOrDirectorInd>X</IndividualTrusteeOrDirectorInd>

<ReportableCompFromOrgAmt>0</ReportableCompFromOrgAmt>

<ReportableCompFromRltdOrgAmt>0</ReportableCompFromRltdOrgAmt>

<OtherCompensationAmt>0</OtherCompensationAmt>

</Form990PartVIISectionAGrp>

<Form990PartVIISectionAGrp>

<PersonNm>HEATHER PIKE</PersonNm>

<TitleTxt>DIRECTOR</TitleTxt>

<AverageHoursPerWeekRt>1.00</AverageHoursPerWeekRt>

<IndividualTrusteeOrDirectorInd>X</IndividualTrusteeOrDirectorInd>

<ReportableCompFromOrgAmt>0</ReportableCompFromOrgAmt>

<ReportableCompFromRltdOrgAmt>0</ReportableCompFromRltdOrgAmt>

<OtherCompensationAmt>0</OtherCompensationAmt>

</Form990PartVIISectionAGrp>

<Form990PartVIISectionAGrp>

<PersonNm>BOB PORTMAN</PersonNm>

<TitleTxt>DIRECTOR</TitleTxt>

<AverageHoursPerWeekRt>1.00</AverageHoursPerWeekRt>

<IndividualTrusteeOrDirectorInd>X</IndividualTrusteeOrDirectorInd>

<ReportableCompFromOrgAmt>0</ReportableCompFromOrgAmt>

<ReportableCompFromRltdOrgAmt>0</ReportableCompFromRltdOrgAmt>

<OtherCompensationAmt>0</OtherCompensationAmt>

</Form990PartVIISectionAGrp>

<Form990PartVIISectionAGrp>

<PersonNm>ROBERT ROSS</PersonNm>

<TitleTxt>CHAIRMAN</TitleTxt>

<AverageHoursPerWeekRt>1.00</AverageHoursPerWeekRt>

<IndividualTrusteeOrDirectorInd>X</IndividualTrusteeOrDirectorInd>

<ReportableCompFromOrgAmt>0</ReportableCompFromOrgAmt>

<ReportableCompFromRltdOrgAmt>0</ReportableCompFromRltdOrgAmt>

<OtherCompensationAmt>0</OtherCompensationAmt>

</Form990PartVIISectionAGrp>

<Form990PartVIISectionAGrp>

<PersonNm>MIKE TERRY</PersonNm>

<TitleTxt>DIRECTOR</TitleTxt>

<AverageHoursPerWeekRt>1.00</AverageHoursPerWeekRt>

<IndividualTrusteeOrDirectorInd>X</IndividualTrusteeOrDirectorInd>

<ReportableCompFromOrgAmt>0</ReportableCompFromOrgAmt>

<ReportableCompFromRltdOrgAmt>0</ReportableCompFromRltdOrgAmt>

<OtherCompensationAmt>0</OtherCompensationAmt>

</Form990PartVIISectionAGrp>

<Form990PartVIISectionAGrp>

<PersonNm>DANITA TESTERMAN</PersonNm>

<TitleTxt>DIRECTOR</TitleTxt>

<AverageHoursPerWeekRt>1.00</AverageHoursPerWeekRt>

<IndividualTrusteeOrDirectorInd>X</IndividualTrusteeOrDirectorInd>

<ReportableCompFromOrgAmt>0</ReportableCompFromOrgAmt>

<ReportableCompFromRltdOrgAmt>0</ReportableCompFromRltdOrgAmt>

<OtherCompensationAmt>0</OtherCompensationAmt>

</Form990PartVIISectionAGrp>

<Form990PartVIISectionAGrp>

<PersonNm>LAUREN WARKENTINE</PersonNm>

<TitleTxt>DIRECTOR</TitleTxt>

<AverageHoursPerWeekRt>1.00</AverageHoursPerWeekRt>

<IndividualTrusteeOrDirectorInd>X</IndividualTrusteeOrDirectorInd>

<ReportableCompFromOrgAmt>0</ReportableCompFromOrgAmt>

<ReportableCompFromRltdOrgAmt>0</ReportableCompFromRltdOrgAmt>

<OtherCompensationAmt>0</OtherCompensationAmt>

</Form990PartVIISectionAGrp>

<TotalReportableCompFromOrgAmt>1132388</TotalReportableCompFromOrgAmt>

<TotalOtherCompensationAmt>91743</TotalOtherCompensationAmt>

<IndivRcvdGreaterThan100KCnt>7</IndivRcvdGreaterThan100KCnt>

<FormerOfcrEmployeesListedInd>false</FormerOfcrEmployeesListedInd>

<TotalCompGreaterThan150KInd>true</TotalCompGreaterThan150KInd>

<CompensationFromOtherSrcsInd>false</CompensationFromOtherSrcsInd>

<GovernmentGrantsAmt>2646222</GovernmentGrantsAmt>

<AllOtherContributionsAmt>2496066</AllOtherContributionsAmt>

<NoncashContributionsAmt>201625</NoncashContributionsAmt>

<TotalContributionsAmt>5142288</TotalContributionsAmt>

<ProgramServiceRevenueGrp>

<Desc>PATIENT SERVICES</Desc>

<TotalRevenueColumnAmt>4817981</TotalRevenueColumnAmt>

<RelatedOrExemptFuncIncomeAmt>4817981</RelatedOrExemptFuncIncomeAmt>

</ProgramServiceRevenueGrp>

<ProgramServiceRevenueGrp>

<Desc>TRAINING & SUPPORT SERVICES</Desc>

<TotalRevenueColumnAmt>195817</TotalRevenueColumnAmt>

<RelatedOrExemptFuncIncomeAmt>195817</RelatedOrExemptFuncIncomeAmt>

</ProgramServiceRevenueGrp>

<ProgramServiceRevenueGrp>

<Desc>TUITION FOR EDUCATIONAL SERV</Desc>

<TotalRevenueColumnAmt>5792</TotalRevenueColumnAmt>

<RelatedOrExemptFuncIncomeAmt>5792</RelatedOrExemptFuncIncomeAmt>

</ProgramServiceRevenueGrp>

<TotalProgramServiceRevenueAmt>5019590</TotalProgramServiceRevenueAmt>

<InvestmentIncomeGrp>

<TotalRevenueColumnAmt>26703</TotalRevenueColumnAmt>

<ExclusionAmt>26703</ExclusionAmt>

</InvestmentIncomeGrp>

<GrossRentsGrp>

<RealAmt>8500</RealAmt>

</GrossRentsGrp>

<RentalIncomeOrLossGrp>

<RealAmt>8500</RealAmt>

</RentalIncomeOrLossGrp>

<NetRentalIncomeOrLossGrp>

<TotalRevenueColumnAmt>8500</TotalRevenueColumnAmt>

<ExclusionAmt>8500</ExclusionAmt>

</NetRentalIncomeOrLossGrp>

<OtherRevenueMiscGrp>

<Desc>REWARDS AND DISCOUNTS</Desc>

<TotalRevenueColumnAmt>20538</TotalRevenueColumnAmt>

<ExclusionAmt>20538</ExclusionAmt>

</OtherRevenueMiscGrp>

<OtherRevenueMiscGrp>

<Desc>MISCELLANEOUS</Desc>

<TotalRevenueColumnAmt>10096</TotalRevenueColumnAmt>

<ExclusionAmt>10096</ExclusionAmt>

</OtherRevenueMiscGrp>

<OtherRevenueMiscGrp>

<Desc>MERCHANDISE SALES</Desc>

<TotalRevenueColumnAmt>3445</TotalRevenueColumnAmt>

<ExclusionAmt>3445</ExclusionAmt>

</OtherRevenueMiscGrp>

<OtherRevenueTotalAmt>34079</OtherRevenueTotalAmt>

<TotalRevenueGrp>

<TotalRevenueColumnAmt>10231160</TotalRevenueColumnAmt>

<RelatedOrExemptFuncIncomeAmt>5019590</RelatedOrExemptFuncIncomeAmt>

<ExclusionAmt>69282</ExclusionAmt>

</TotalRevenueGrp>

<CompCurrentOfcrDirectorsGrp>

<TotalAmt>435578</TotalAmt>

<ProgramServicesAmt>106589</ProgramServicesAmt>

<ManagementAndGeneralAmt>324127</ManagementAndGeneralAmt>

<FundraisingAmt>4862</FundraisingAmt>

</CompCurrentOfcrDirectorsGrp>

<OtherSalariesAndWagesGrp>

<TotalAmt>4961586</TotalAmt>

<ProgramServicesAmt>4640015</ProgramServicesAmt>

<ManagementAndGeneralAmt>71864</ManagementAndGeneralAmt>

<FundraisingAmt>249707</FundraisingAmt>

</OtherSalariesAndWagesGrp>

<PensionPlanContributionsGrp>

<TotalAmt>114615</TotalAmt>

<ProgramServicesAmt>104099</ProgramServicesAmt>

<ManagementAndGeneralAmt>5258</ManagementAndGeneralAmt>

<FundraisingAmt>5258</FundraisingAmt>

</PensionPlanContributionsGrp>

<OtherEmployeeBenefitsGrp>

<TotalAmt>690863</TotalAmt>

<ProgramServicesAmt>608577</ProgramServicesAmt>

<ManagementAndGeneralAmt>43989</ManagementAndGeneralAmt>

<FundraisingAmt>38297</FundraisingAmt>

</OtherEmployeeBenefitsGrp>

<PayrollTaxesGrp>

<TotalAmt>390996</TotalAmt>

<ProgramServicesAmt>345521</ProgramServicesAmt>

<ManagementAndGeneralAmt>26761</ManagementAndGeneralAmt>

<FundraisingAmt>18714</FundraisingAmt>

</PayrollTaxesGrp>

<FeesForServicesLegalGrp>

<TotalAmt>26555</TotalAmt>

<ProgramServicesAmt>1466</ProgramServicesAmt>

<ManagementAndGeneralAmt>25022</ManagementAndGeneralAmt>

<FundraisingAmt>67</FundraisingAmt>

</FeesForServicesLegalGrp>

<FeesForServicesAccountingGrp>

<TotalAmt>14250</TotalAmt>

<ProgramServicesAmt>13058</ProgramServicesAmt>

<ManagementAndGeneralAmt>596</ManagementAndGeneralAmt>

<FundraisingAmt>596</FundraisingAmt>

</FeesForServicesAccountingGrp>

<FeesForServicesOtherGrp>

<TotalAmt>13524</TotalAmt>

<ProgramServicesAmt>13314</ProgramServicesAmt>

<ManagementAndGeneralAmt>105</ManagementAndGeneralAmt>

<FundraisingAmt>105</FundraisingAmt>

</FeesForServicesOtherGrp>

<AdvertisingGrp>

<TotalAmt>214214</TotalAmt>

<ProgramServicesAmt>192860</ProgramServicesAmt>

<ManagementAndGeneralAmt>7399</ManagementAndGeneralAmt>

<FundraisingAmt>13955</FundraisingAmt>

</AdvertisingGrp>

<OccupancyGrp>

<TotalAmt>346985</TotalAmt>

<ProgramServicesAmt>327265</ProgramServicesAmt>

<ManagementAndGeneralAmt>10090</ManagementAndGeneralAmt>

<FundraisingAmt>9630</FundraisingAmt>

</OccupancyGrp>

<DepreciationDepletionGrp>

<TotalAmt>756305</TotalAmt>

<ProgramServicesAmt>715629</ProgramServicesAmt>

<ManagementAndGeneralAmt>20338</ManagementAndGeneralAmt>

<FundraisingAmt>20338</FundraisingAmt>

</DepreciationDepletionGrp>

<OtherExpensesGrp>

<Desc>HEARING TECHNOLOGY</Desc>

<TotalAmt>1110055</TotalAmt>

<ProgramServicesAmt>1110055</ProgramServicesAmt>

</OtherExpensesGrp>

<OtherExpensesGrp>

<Desc>OTHER EXPENSES</Desc>

<TotalAmt>232579</TotalAmt>

<ProgramServicesAmt>210316</ProgramServicesAmt>

<ManagementAndGeneralAmt>12683</ManagementAndGeneralAmt>

<FundraisingAmt>9580</FundraisingAmt>

</OtherExpensesGrp>

<OtherExpensesGrp>

<Desc>COMPUTER SYSTEM EXPENSES</Desc>

<TotalAmt>186861</TotalAmt>

<ProgramServicesAmt>173354</ProgramServicesAmt>

<ManagementAndGeneralAmt>5525</ManagementAndGeneralAmt>

<FundraisingAmt>7982</FundraisingAmt>

</OtherExpensesGrp>

<OtherExpensesGrp>

<Desc>SUPPLIES</Desc>

<TotalAmt>78842</TotalAmt>

<ProgramServicesAmt>75728</ProgramServicesAmt>

<ManagementAndGeneralAmt>2033</ManagementAndGeneralAmt>

<FundraisingAmt>1081</FundraisingAmt>

</OtherExpensesGrp>

<AllOtherExpensesGrp>

<TotalAmt>79432</TotalAmt>

<ProgramServicesAmt>63411</ProgramServicesAmt>

<ManagementAndGeneralAmt>11</ManagementAndGeneralAmt>

<FundraisingAmt>16010</FundraisingAmt>

</AllOtherExpensesGrp>

<TotalFunctionalExpensesGrp>

<TotalAmt>9653240</TotalAmt>

<ProgramServicesAmt>8701257</ProgramServicesAmt>

<ManagementAndGeneralAmt>555801</ManagementAndGeneralAmt>

<FundraisingAmt>396182</FundraisingAmt>

</TotalFunctionalExpensesGrp>

<CashNonInterestBearingGrp>

<BOYAmt>2398382</BOYAmt>

<EOYAmt>4789811</EOYAmt>

</CashNonInterestBearingGrp>

<PledgesAndGrantsReceivableGrp>

<BOYAmt>596650</BOYAmt>

</PledgesAndGrantsReceivableGrp>

<AccountsReceivableGrp>

<BOYAmt>535301</BOYAmt>

<EOYAmt>734011</EOYAmt>

</AccountsReceivableGrp>

<InventoriesForSaleOrUseGrp>

<EOYAmt>66887</EOYAmt>

</InventoriesForSaleOrUseGrp>

<PrepaidExpensesDefrdChargesGrp>

<BOYAmt>40690</BOYAmt>

<EOYAmt>58927</EOYAmt>

**DELETED DATA TO KEEP CHARACTER COUNT DOWN**

**DELETED DATA TO KEEP CHARACTER COUNT DOWN**

**DELETED DATA TO KEEP CHARACTER COUNT DOWN**

</SupplementalInformationDetail>

</IRS990ScheduleO>

</ReturnData>

</Return>